Your Personal Financial Planner

Illuminating the Path to

Financial Empowerment

Financial planning is easier with Light Financial Education

At the heart of our firm lies a bold and ambitious vision - to create a world where financial literacy is the foundation for personal and societal prosperity.

We are Light Financial Education

At LFE, we offer comprehensive financial planning services and engaging workshops designed for various audiences, including corporate professionals, students, and educational institutions. Our services cover the entire spectrum of personal finance, ensuring that you have the knowledge and tools necessary to manage your finances effectively.

Holistic Financial Planning

From budgeting and saving to investing and retirement planning, we provide a complete suite of services tailored to your unique needs.

Workshops for All

Our workshops cater to corporate teams, students, and CFP certification candidates, making financial literacy accessible to all.

Transparent Pricing

We pride ourselves on our unique selling points— You will always know what you pay and why, eliminating any hidden fees or surprises.

Expert Guidance

Our team consists of qualified and educated financial planners dedicated to helping you navigate the complexities of personal finance.

Wealth Courses to Achieve Financial Freedom

At LFE, we offer comprehensive financial planning services and engaging workshops designed for various audiences, including corporate professionals, students, and educational institutions. Our services cover the entire spectrum of personal finance, ensuring that you have the knowledge and tools necessary to manage your finances effectively.

6-8 Weeks Time

Foundation Course

Build essential financial skills for a secure and confident future.

6-8 Weeks Time

Expert Course

Advance your financial expertise for strategic, impactful decisions.

Variable Time

Customized Course

Shape a financial plan tailored to your unique goals and ambitions.

Financial Planning Services We Provide

At LFE, our primary focus is helping individuals and families achieve their financial goals through personalized planning. We offer a comprehensive suite of services designed to address every aspect of your financial well-being. Our commitment to transparency and honesty ensures that you have a clear understanding of your financial situation and the steps necessary to reach your objectives.

Retirement Planning

Planning for retirement is one of the most important aspects of financial security. Our retirement planning services help you develop a strategy that aligns with your desired lifestyle and ensures a comfortable future. We'll work closely with you to:

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Investment Management

Effective investment management is crucial for growing your wealth and achieving your financial objectives. Our team of investment professionals will work with you to:

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Tax Planning

Minimizing your tax liability is an essential part of financial planning. Our tax planning services help you identify opportunities to reduce your taxes and keep more of your hard-earned money. We'll work with you to

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Estate Planning

Protecting your assets and ensuring their smooth transfer to your loved ones is crucial in financial planning. Our estate planning services help you create a comprehensive plan that aligns with your wishes and minimizes potential conflicts. We'll work with you to:

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Risk Management and Insurance

Protecting yourself and your family from unexpected events is essential for financial security. Our risk management and insurance services help you identify potential risks and implement strategies to mitigate them. We'll work with you to

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Budgeting and Savings

Developing a solid financial foundation is the key to achieving your goals. Our budgeting and savings services help you create a plan that aligns your spending with your priorities and ensures that you're saving for the future. We'll work with you to:

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

- Analyze your current tax situation and identify potential areas for savings

Our Financial Literacy Workshops

Light Financial Education helps you optimize your productivity by providing a comprehensive solution that brings together all your tools and tasks into a unified platform, enabling seamless collaboration and efficient workflow management.

Workshops for School Students

Our school workshops are tailored to engage and educate students from grades 6 to 12. We cover a wide range of topics, including:

- Budgeting and saving, Modern money.

- Understanding Banks, credit and debt.

- Investing

- Protecting against financial risks

- Entrepreneurship and financial planning

By introducing financial concepts early on, we aim to equip students with the knowledge and skills they need to make informed decisions and build a strong financial foundation for their future.

Workshops for College Students

Our college workshops are designed to help young adults navigate the complexities of personal finance as they transition into adulthood. We cover topics such as:

- Managing student loans and debt

- Budgeting for independent living

- Investing for long-term goals

- Understanding employer benefits and retirement plans

- Protecting against identity theft and financial fraud

Our interactive sessions encourage active participation and provide practical tools and resources to help students apply what they've learned in their daily lives.

CFP (Certified Financial Planner)

The CFP course is a globally recognized certification that prepares aspiring financial planners to provide expert advice and guidance in personal finance. Our curriculum is aligned with the CFP Board's Principal Knowledge Topics and covers a wide range of essential subjects, including:

- Personal Financial Management

- Investment Planning & Asset Management

- Retirement and Tax Planning

- Risk and Estate Planning

- Financial Plan Construction

Community Workshops

Our community workshops are open to the public and aim to reach a diverse audience with the message of financial empowerment. We cover topics such as:

- Basics of personal finance

- Saving and investing for beginners

- Retirement planning for all ages

- Financial planning for small business owners

- Estate planning and legacy building

Corporate Financial Education

We offer customized financial education programs for corporate clients, tailored to the needs and goals of their employees. Our workshops cover a wide range of topics, including:

- Retirement planning and investment strategies

- Tax optimization and financial planning

- Employee benefits and financial wellness

- Financial planning for life events (marriage, parenthood, etc.)

- Debt management and credit optimization

By investing in the financial well-being of their employees, companies can boost morale, productivity, and retention while demonstrating their commitment to their workforce

Workshops for School Students

Our school workshops are tailored to engage and educate students from grades 6 to 12. We cover a wide range of topics, including:

- Budgeting and saving, Modern money.

- Understanding Banks, credit and debt.

- Investing

- Protecting against financial risks

- Entrepreneurship and financial planning

By introducing financial concepts early on, we aim to equip students with the knowledge and skills they need to make informed decisions and build a strong financial foundation for their future.

Workshops for College Students

Our college workshops are designed to help young adults navigate the complexities of personal finance as they transition into adulthood. We cover topics such as:

- Managing student loans and debt

- Budgeting for independent living

- Investing for long-term goals

- Understanding employer benefits and retirement plans

- Protecting against identity theft and financial fraud

Our interactive sessions encourage active participation and provide practical tools and resources to help students apply what they've learned in their daily lives.

CFP (Certified Financial Planner)

The CFP course is a globally recognized certification that prepares aspiring financial planners to provide expert advice and guidance in personal finance. Our curriculum is aligned with the CFP Board's Principal Knowledge Topics and covers a wide range of essential subjects, including:

- Personal Financial Management

- Investment Planning & Asset Management

- Retirement and Tax Planning

- Risk and Estate Planning

- Financial Plan Construction

Community Workshops

Our community workshops are open to the public and aim to reach a diverse audience with the message of financial empowerment. We cover topics such as:

- Basics of personal finance

- Saving and investing for beginners

- Retirement planning for all ages

- Financial planning for small business owners

- Estate planning and legacy building

Corporate Financial Education

We offer customized financial education programs for corporate clients, tailored to the needs and goals of their employees. Our workshops cover a wide range of topics, including:

- Retirement planning and investment strategies

- Tax optimization and financial planning

- Employee benefits and financial wellness

- Financial planning for life events (marriage, parenthood, etc.)

- Debt management and credit optimization

By investing in the financial well-being of their employees, companies can boost morale, productivity, and retention while demonstrating their commitment to their workforce

Workshops for School Students

Our school workshops are tailored to engage and educate students from grades 6 to 12. We cover a wide range of topics, including:

- Budgeting and saving, Modern money.

- Understanding Banks, credit and debt.

- Investing

- Protecting against financial risks

- Entrepreneurship and financial planning

By introducing financial concepts early on, we aim to equip students with the knowledge and skills they need to make informed decisions and build a strong financial foundation for their future.

Workshops for College Students

Our college workshops are designed to help young adults navigate the complexities of personal finance as they transition into adulthood. We cover topics such as:

- Managing student loans and debt

- Budgeting for independent living

- Investing for long-term goals

- Understanding employer benefits and retirement plans

- Protecting against identity theft and financial fraud

Our interactive sessions encourage active participation and provide practical tools and resources to help students apply what they've learned in their daily lives.

CFP (Certified Financial Planner)

The CFP course is a globally recognized certification that prepares aspiring financial planners to provide expert advice and guidance in personal finance. Our curriculum is aligned with the CFP Board's Principal Knowledge Topics and covers a wide range of essential subjects, including:

- Personal Financial Management

- Investment Planning & Asset Management

- Retirement and Tax Planning

- Risk and Estate Planning

- Financial Plan Construction

Community Workshops

Our community workshops are open to the public and aim to reach a diverse audience with the message of financial empowerment. We cover topics such as:

- Basics of personal finance

- Saving and investing for beginners

- Retirement planning for all ages

- Financial planning for small business owners

- Estate planning and legacy building

Corporate Financial Education

We offer customized financial education programs for corporate clients, tailored to the needs and goals of their employees. Our workshops cover a wide range of topics, including:

- Retirement planning and investment strategies

- Tax optimization and financial planning

- Employee benefits and financial wellness

- Financial planning for life events (marriage, parenthood, etc.)

- Debt management and credit optimization

By investing in the financial well-being of their employees, companies can boost morale, productivity, and retention while demonstrating their commitment to their workforce

Why Financial Literacy Matters?

In today's fast-paced economic landscape, financial literacy is crucial. Understanding budgeting, saving, investing, and managing debt empowers individuals to make informed financial decisions. This knowledge helps avoid common pitfalls and achieve long-term goals like home ownership and retirement planning.

Safe retirement

Wealth accumulation

Debt management

Financial security

Investment growth

Budget control

Credit improvement

Emergency savings

Tax optimization

Home ownership

Smart spending

Financial independence

Long-term planning

Wealth preservation

Intelligent Task Prioritization

Contextual Understanding

Personalized Insights

Simple Navigation

Smart Suggestions

Easy Collaboration

Why Financial Literacy Matters?

In today's fast-paced economic landscape, financial literacy is crucial. Understanding budgeting, saving, investing, and managing debt empowers individuals to make informed financial decisions. This knowledge helps avoid common pitfalls and achieve long-term goals like home ownership and retirement planning.

Safe retirement

Wealth accumulation

Debt management

Financial security

Investment growth

Budget control

Credit improvement

Emergency savings

Tax optimization

Home ownership

Smart spending

Financial independence

Long-term planning

Wealth preservation

Intelligent Task Prioritization

Contextual Understanding

Personalized Insights

Simple Navigation

Smart Suggestions

Easy Collaboration

Why Financial Literacy Matters?

In today's fast-paced economic landscape, financial literacy is crucial. Understanding budgeting, saving, investing, and managing debt empowers individuals to make informed financial decisions. This knowledge helps avoid common pitfalls and achieve long-term goals like home ownership and retirement planning.

Safe retirement

Wealth accumulation

Debt management

Financial security

Investment growth

Budget control

Credit improvement

Emergency savings

Tax optimization

Home ownership

Smart spending

Financial independence

Long-term planning

Wealth preservation

Intelligent Task Prioritization

Contextual Understanding

Personalized Insights

Simple Navigation

Smart Suggestions

Easy Collaboration

Testimonials

Don't just believe, see what people say about us!

"The workshop was so good. I got to know many things, how can we invest money. One thought I’ll always remember is, 'Don’t work for money. Make money work for you'"

Jatin, Student

"The workshop on finance was very nice. I got to know very much about how we can earn & we can invest our money & earn our own money"

Daksh, Krish, Vansh (Students)

"This workshop was very helpful for us because if we don’t know about the finance, then what we do in future. So, that the workshop was knowledgeable for us, such workshops should be conducted frequently."

Suraj, Sourabh, Mohin (Students)

"I loved the experience of Financial workshop. I learned a lot about investment and shares. It was a very good workshop and our interaction with the teachers was also very good and I wish we’ll attend more workshops like this in future."

Bhavya (Student)

100% Results

We believe that financial literacy is a crucial life skill. Our workshop not only educated students but also inspired them to think critically about their financial futures.

Testimonials

Don't just believe, see what people say about us!

"The workshop was so good. I got to know many things, how can we invest money. One thought I’ll always remember is, 'Don’t work for money. Make money work for you'"

Jatin, Student

"The workshop on finance was very nice. I got to know very much about how we can earn & we can invest our money & earn our own money"

Daksh, Krish, Vansh (Students)

"This workshop was very helpful for us because if we don’t know about the finance, then what we do in future. So, that the workshop was knowledgeable for us, such workshops should be conducted frequently."

Suraj, Sourabh, Mohin (Students)

"I loved the experience of Financial workshop. I learned a lot about investment and shares. It was a very good workshop and our interaction with the teachers was also very good and I wish we’ll attend more workshops like this in future."

Bhavya (Student)

100% Results

We believe that financial literacy is a crucial life skill. Our workshop not only educated students but also inspired them to think critically about their financial futures.

Testimonials

Don't just believe, see what people say about us!

"The workshop was so good. I got to know many things, how can we invest money. One thought I’ll always remember is, 'Don’t work for money. Make money work for you'"

Jatin, Student

"The workshop on finance was very nice. I got to know very much about how we can earn & we can invest our money & earn our own money"

Daksh, Krish, Vansh (Students)

"This workshop was very helpful for us because if we don’t know about the finance, then what we do in future. So, that workshop was knowledgeable for us, such workshops should be conducted frequently."

Suraj, Sourabh, Mohin (Students)

"I loved the experience of Financial workshop. I learned a lot about investment and shares. I wish we’ll attend more workshops like this in future."

Bhavya (Student)

100% Results

We believe that financial literacy is a crucial life skill. Our workshop not only educated students but also inspired them to think critically about their financial futures.

Our Blog

Our blog covers a wide range of financial topics. Never miss an article.

Events

We are dedicated to fostering financial literacy through engaging workshops and events tailored for various audiences. Stay updated with our various events.

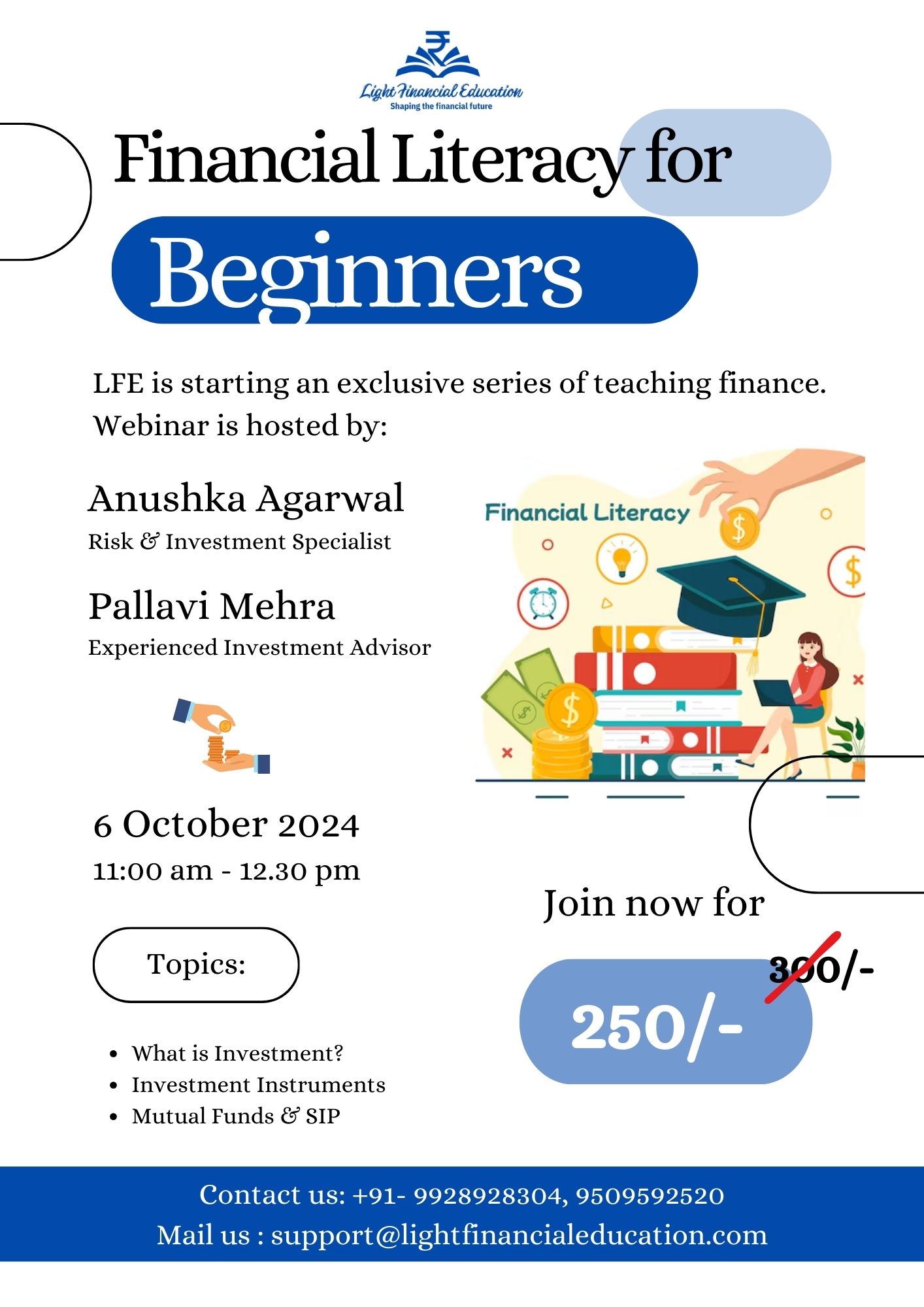

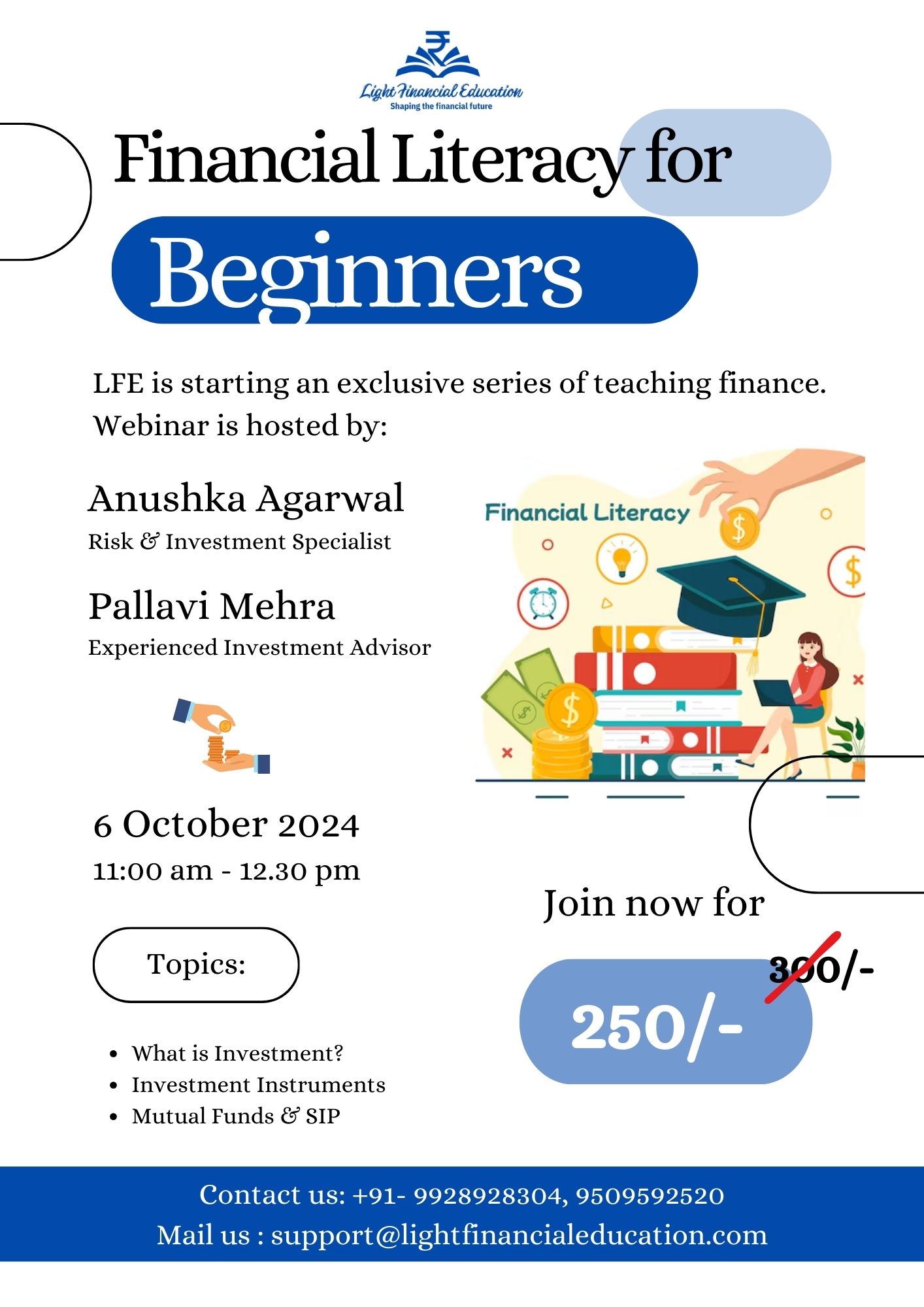

Financial Literacy Workshop for Beginners

Financial Literacy Workshop for Beginners

Oct 6, 2024

Oct 6, 2024

Financial Literacy Workshop at Lords University (UG and PG)

Financial Literacy Workshop at Lords University (UG and PG)

May 29, 2024

May 29, 2024

Financial Literacy Workshop at Lords International School

Financial Literacy Workshop at Lords International School

May 30, 2024

May 30, 2024

Financial Literacy Workshop at Anselm's (Grades 8-9)

Financial Literacy Workshop at Anselm's (Grades 8-9)

Jul 13, 2024

Jul 13, 2024

Frequently Asked Questions

Have more questions? Reach out at lightfinancialeducation@gmail.com

Who are the instructors?

Are the courses self-paced?

Do I need any prior knowledge to enroll?

Is there customer support available?

Can I preview course content before enrolling?